Decentralized change protocols that permit crypto merchants and buyers to commerce throughout totally different blockсhains have been in improvement for some time. A major new improvement now comes with the launch of the “Testnet” from Injective Protocol. Injective has been backed by Binance, one of many largest centralized exchanges within the crypto world.

Injective Protocol is without doubt one of the first common “DeFi” (Decentralised Finance) protocols for cross-chain derivatives buying and selling, so the launch of the Testnet is a vital milestone. Injective’s foremost rivals (centralized and decentralized exchanges) embody CME Group, BitMEX, LedgerX and OKEx, amongst others.

In addition to being incubated by Binance Labs, Injective Protocol can be backed with $3 million in funding from famous blockchain buyers Pantera, Hashed and others. Pantera has had some profitable exits, together with Kik, Bitstamp and Blockfolio.

Paul Veradittakit, companion at Pantera Capital, stated in an announcement: “Injective’s Solstice testnet trades and appears like a state-of-the-art derivatives change nevertheless it’s truly completely supported by a completely decentralized infrastructure. With a 1 second blocktime, instantaneous finality, and full EVM assist, I’m assured that Injective will have the ability to pioneer the following wave of decentralized derivatives buying and selling”.

Injective’s staff emerged from Stanford College and has been constructing and testing its platform privately since 2018, whereas validating it with a number of giant funds, market makers and institutional merchants. Previous to Injective, Eric Chen, CEO and сo-founder, was working at hedge funds and labored in cryptographic analysis at a blockchain-focused fund.

Injective has been working towards a mainnet and has already introduced partnerships with high blockchain firms corresponding to Elrond, Ramp DeFi, Findora and Frontier. Its layer-2 decentralized change protocol lets merchants commerce throughout Ethereum, Cosmos and others, utilizing Tendermint-based Proof-of-Stake (PoS) to facilitate cross-chain derivatives buying and selling.

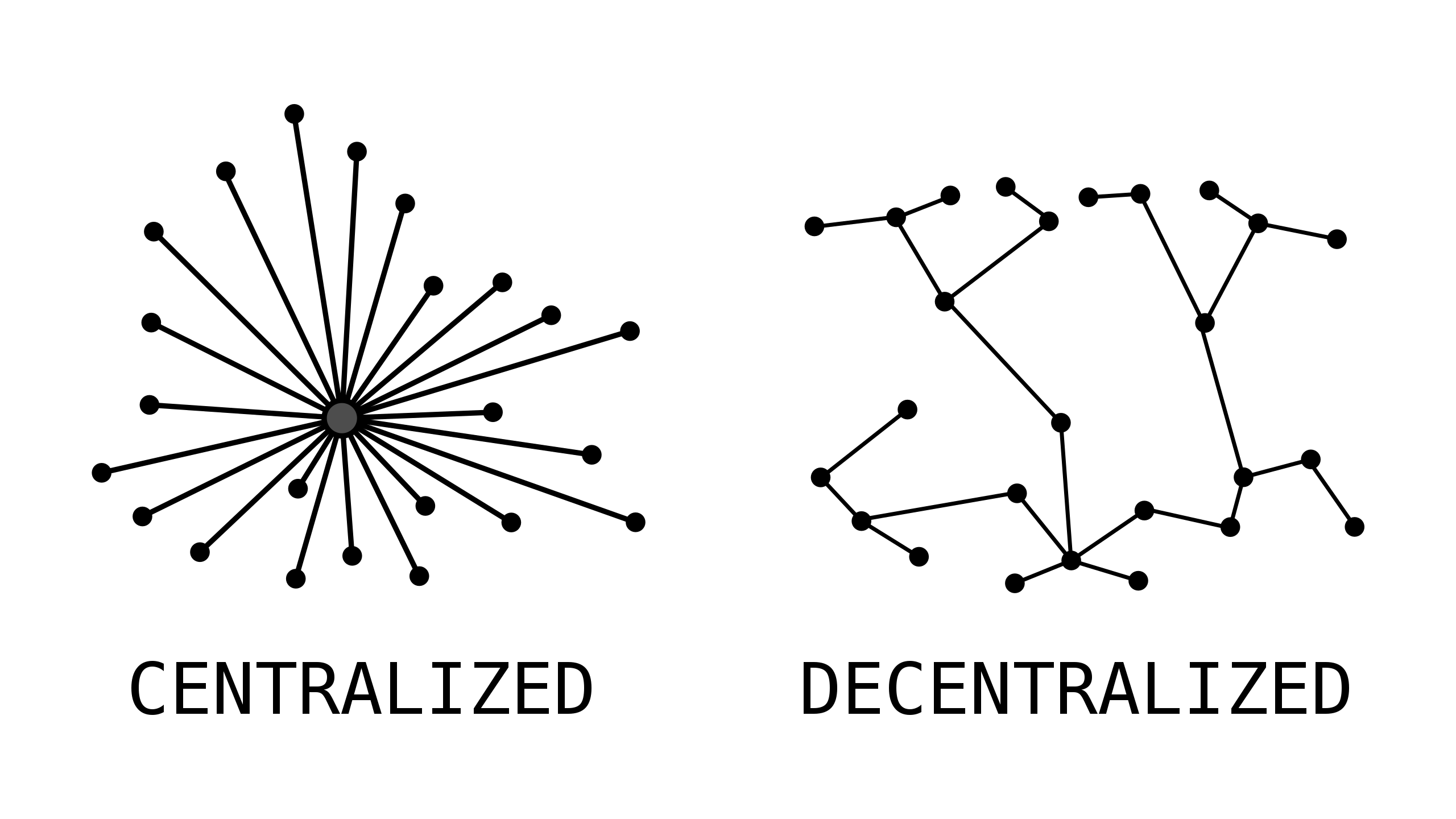

Centralized exchanges have been recognized for operational failures like entrance operating, exit scams and change hacks. On the similar time, present DEXs are nonetheless dealing with issues corresponding to excessive transaction charges, low liquidity, inconvenient UI/UX and sluggish speeds. However the buying and selling quantity of decentralized exchanges reportedly grew 70% in the course of 2020, setting a latest report excessive of $1.52 billion. So there’s clearly an urge for food for this method.

The benefit of the method utilized by Injective combines the benefits of decentralized exchanges: resistance to entrance operating, scams and hacks, with the pace, low transaction charges and no fuel charges solely beforehand accessible with centralized platforms. Builders may create their very own derivatives and markets to commerce.

With Bitcoin reaching an all-time-high at round $18,000, the blockchain and crypto world is as soon as once more taking off.

PayPal bought as much as 70% of all of the newly mined bitcoin for the reason that funds big began providing cryptocurrency companies. And Guggenheim Funds Belief filed an modification with the U.S. Securities and Change Fee to permit its $5 billion Macro Alternatives Fund acquire publicity to bitcoin by investing as much as 10% of the fund’s web asset worth within the Grayscale Bitcoin Belief.

Source link