Shops that comply with the crypto business have been observing a trend, which is that in line with Google search knowledge, the rise in curiosity in non-fungible tokens, or NFTs, now virtually matches the extent of curiosity in 2017 in preliminary coin choices, or ICOs.

In fact, ICOs largely disappeared from the scene after the SEC began poking round and figuring out, in some instances, that they have been getting used to launder money. Now specialists in blockchain transactions see the potential for abuse once more with NFTs, regardless of the traceable nature of the tokens — and maybe even due to it.

As most readers might know at this level (as a result of they’re more and more exhausting to keep away from), an NFT is a type of digital collectible that may are available virtually any type — a PDF, a tweet… even a digitized New York Times column.

Every of this stuff — and there might be many copies of the identical merchandise — is stamped with a protracted string of alphanumerics that makes it immutable. As early crypto investor David Pakman of Venrock explains it, that code can also be recorded on the blockchain, in order that there’s a everlasting report of who owns what. Another person can screenshot that PDF or tweet or Occasions column, however they received’t have the ability to do something with that screenshot, whereas the NFT proprietor can, theoretically no less than, promote that collectible sooner or later to the next bidder.

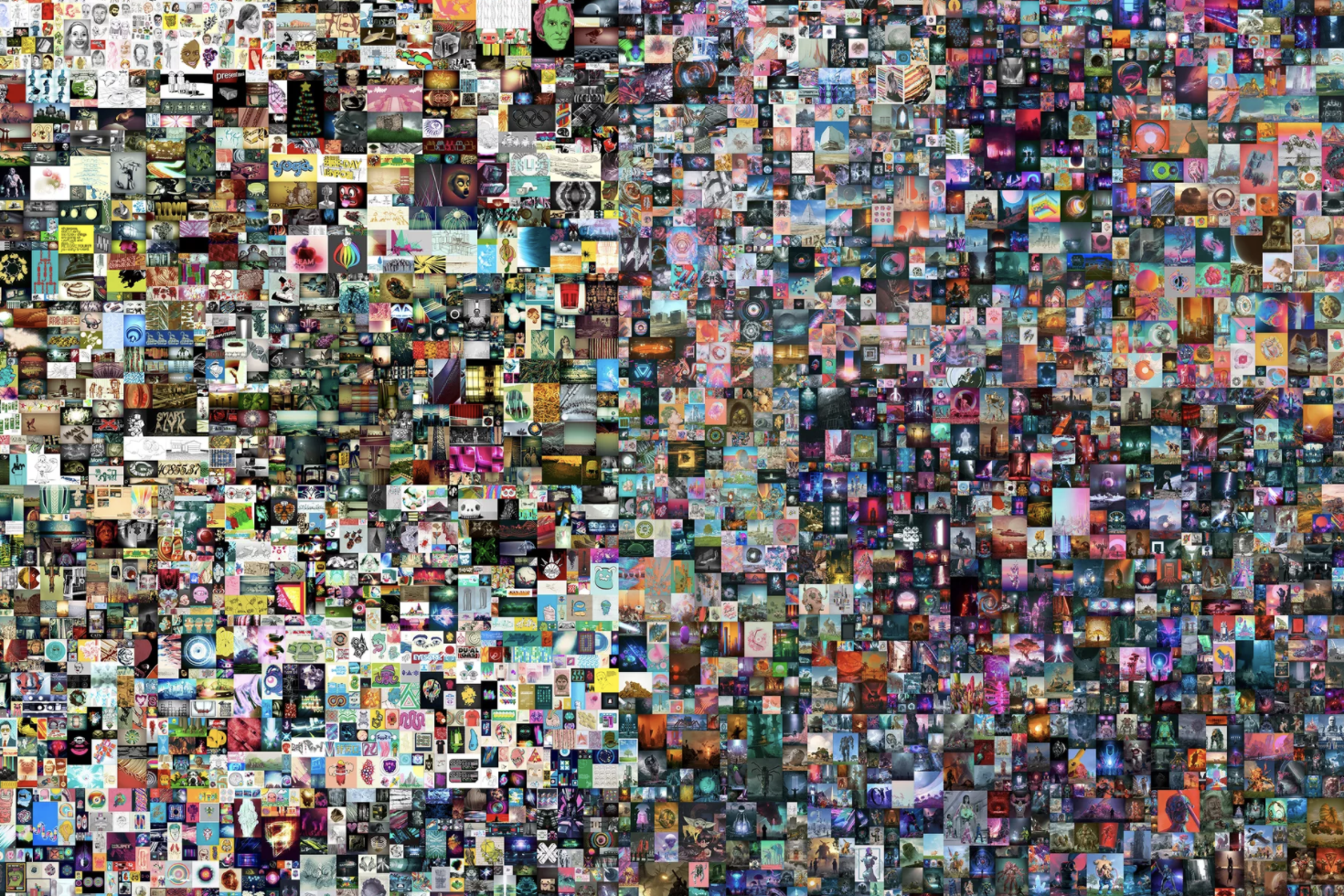

The largest NFT sale thus far, about 15 days in the past, was the sale of digital artist Mike Winkelmann’s “Everydays: The First 5000 Days,” which offered for a surprising $69 million — the third-highest auction price achieved for a residing artist, after Jeff Koons and David Hockney. Winkelmann, who makes use of the title Beeple, broke his personal report with the sale, having offered one other crypto artwork piece for $6.6 million in February. (Earlier this week, he offered yet one more for $6 million.) There may be such a frenzy that Beeple has advised quite a few shops that he believes there’s a crypto artwork “bubble” and that many NFTs will “absolutely go to zero.”

There may be a lot cash concerned that specialists imagine that NFTs have change into a rife alternative for unhealthy actors, even when motion hasn’t been introduced in opposition to one but.

One of the vital sensible risks facilities on trade-based cash laundering, or the method of disguising unlawful proceeds by shifting them via commerce transactions in an effort to legitimize them. It’s already an enormous challenge within the artwork world, and NFTs are akin to artwork, with much more erratic pricing proper now.

Jesse Spiro, the chief of presidency affairs on the blockchain evaluation agency Chainalysis explains it this fashion: “One of many methods to determine trade-based cash laundering with [traditional] artwork is that [an appraiser] comes up with a good market worth for one thing, and also you’re in a position to measure that truthful market worth in opposition to the pricing that’s concerned [and flag] over-invoicing or under-invoicing, which is both promoting that asset for lower than it’s value, or for greater than it’s value.”

The excellent news is that in some situations the place a whole lot and even 1000’s of NFTs are being offered — even at very completely different costs, as has been taking place with NBA highlight clips — there’s a mean worth that may be measured, Spiro notes, and that makes uncommon exercise simpler to identify.

In instances the place it’s unattainable to ascertain a gross sales historical past, nonetheless, the last word worth “could possibly be regardless of the purchaser is prepared to pay for one thing, so you possibly can’t actually make that dedication” that one thing nefarious is afoot. In keeping with Spiro, “All that’s wanted is 2 events which might be concerned to successfully execute that [transaction] efficiently.”

There are numerous different flavors of crime on the subject of digital belongings and, probably, with regard to NFTs. Asaf Meir, the co-founder and CEO of the crypto market surveillance firm Solidus Labs, factors as examples to clean trades, the place a person or outfit concurrently sells and buys the identical monetary devices; in addition to cross trades, which contain a commerce between two accounts throughout the similar group, all to create a false report across the worth of an asset that doesn’t replicate the true market worth.

Each are unlawful beneath cash laundering legal guidelines and likewise very exhausting to identify, particularly for legacy methods. The “tough factor concerning the crypto markets is they’re retail-oriented first, so there could possibly be a number of completely different accounts with a number of addresses doing a number of issues in collusion — generally blended or not blended with institutional accounts for various helpful house owners,” says Meir, who met his co-founders at Goldman Sachs, the place they labored on the digital buying and selling desk for equities and shortly noticed that surveillance for digital belongings was very a lot an unsolved challenge.

It’s value noting that not everybody thinks it doubtless that NFTs are getting used to switch cash illegally. Says Pakman, an investor within the NFT market Dapper Labs, “Crytpo purists are upset this occurred, however nationwide governments can go to marketplaces and exchanges and so they can say, ‘So as so that you can do enterprise, you should comply with [know-your-customer] and [anti-money-laundering] legal guidelines that power [these entities] to get a verified determine of everybody of their clients.’ Then any suspicious transactions over a certain quantity, they should file paperwork.”

The 2 instruments make it simpler for authorities to subpoena the marketplaces and exchanges when a suspicious transaction is flagged and power them to confirm a consumer’s id.

Nonetheless, one query is how efficient that course of is that if sufficient time elapses between the suspicious transaction and it being flagged. Pakman solutions that “every thing is retroactively researchable. When you get away with it at present, there’s nothing to cease the FBI from monitoring it a yr later.”

One other query is why cash launderers would hassle with NFTs when there are simpler methods to switch massive sums of cash within the crypto world. Max Galka, co-founder and CEO of the blockchain analytics platform Elementus, says that “one piece that type of makes me suppose NFTs won’t be the very best automobile for cash laundering is simply that secondary markets aren’t as liquid,” that means it isn’t really easy for unhealthy actors to create distance between themselves and a transaction.

Galka — a former securities dealer with each Deutsche Financial institution and Credit score Suisse — additionally wonders whether or not a prison wouldn’t as a substitute merely go to a decentralized alternate and purchase up liquid tokens which might be actually fungible (that means no distinctive info might be written into the token) in order that the placement of these funds is more durable to hint than with a nonfungible token.

“I definitely see the potential for cash laundering right here, however provided that there are many belongings on the market on the blockchain that individuals can use for that, [NFTs] will not be best-suited” in contrast with their different choices, says Galka.

Theoretically, Spiro of Chainalysis agrees on all fronts, however he means that the minting and sale of NFTs have ballooned so quick that loads of processes that must be in place aren’t.

“Most NFTs function on the Ethereum blockchain, so it’s technically true that these are traceable,” he says. It’s additionally true that “the entities working these NFTs ought to have compliance and work with blockchain forensics and analytics to make sure that somebody is ready to comply with the stream of funds.”

Certainly, he says, in an “excellent world, you’d have the ability to comply with transactions, after which on the choke factors the place people have been making an attempt to transform no matter token they’re utilizing into possibly fiat foreign money, they’d have to supply their [personal identifiable information]” and legislation enforcement or regulators may then see if the transaction was related to illicit exercise.

We’re not there but, although, as grew to become obvious throughout a heist earlier this month on the Nifty Gateway, a web site for purchasing and promoting NFTs. Its clients may need completely misplaced their collectibles had the thieves who stole their holdings been extra subtle.

“Proper now,” says Spiro, “compliance in relation to those NFTs is a grey space.”

Within the meantime, he provides, “Relating to cash laundering, simpler isn’t all the time greatest. The unhealthy actors are on the lookout for the methods which might be most certainly for them to not be caught laundering cash, and whereas that’s to not say that it’s NFTs, in the event that they discover an avenue that they’ll exploit, they are going to. They’re all the time probing the fence and on the lookout for the holes.”

Source link