Temu, a purchasing app from Chinese language e-commerce large Pinduoduo, is having fairly the run because the No. 1 app on the U.S. app shops. The cellular purchasing app hit the highest spot on the U.S. App Retailer in September and has continued to carry a extremely ranked place within the months that adopted, together with because the No. 1 free app on Google Play since December 29, 2022. Extra just lately, Temu as soon as once more snagged the No. 1 place on the iOS App Retailer on January 3 and hasn’t dropped since.

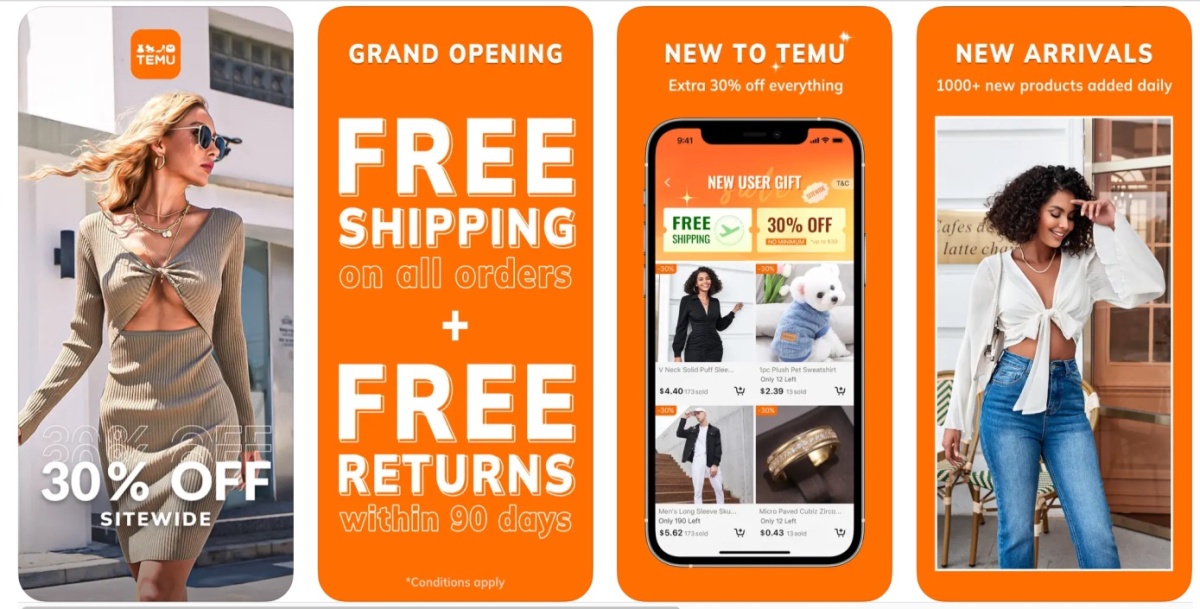

Providing low cost factory-to-consumer items, Temu gives entry to a variety of merchandise, together with quick vogue, and pushes customers to share the app with associates in change free of charge merchandise, which can account for a few of its development. Nevertheless, a lot of its new installs come from Temu’s advertising and marketing spend, it appears.

When covered Temu’s rise in November, the app had then seen a little bit greater than 5 million installs within the U.S., based on knowledge from app intelligence agency Sensor Tower, making the U.S. its largest market. Now the agency says the app has seen 5 million U.S. installs this January alone, up 19% from 4.2 million within the prior 22 days from December 10 by means of December 31.

In accordance with Sensor Tower estimates, Temu has managed to realize a complete of 19 million lifetime installs throughout the App Retailer and Google Play, greater than 18 million of which got here from the U.S.

The expansion now sees Temu outpacing rival Shein by way of each day installs. In October, Temu was averaging round 43,000 each day installs within the U.S., the agency mentioned, whereas Shein averaged about 62,000. In November, Temu’s common each day installs grew to 185,000 whereas Shein’s climbed to 70,000, and final month, Temu averaged 187,000 installs whereas Shein noticed about 62,000.

The purchasing app’s quick rise remembers how the video leisure platform TikTok grew to turn out to be the most downloaded app worldwide in 2021, after years of outsized development. The video app topped 2 billion lifetime downloads by 2020, together with sister app Douyin in China, Sensor Tower mentioned. Mixed, the TikTok apps have now reached 4.1 billion installs.

Like Temu, a lot of TikTok’s early development was pushed by advertising and marketing spend. The video app grew its footprint within the U.S. and overseas by closely leveraging Fb, Instagram, and Snapchat’s personal advert platforms to amass its clients. TikTok was famously mentioned to have spent $1 billion on ads in 2018, even changing into Snap’s largest advertiser that 12 months, for example.

By investing in person acquisition upfront, TikTok was capable of acquire a following, which then improved its skill to personalize its For You feed with suggestions. Over time, this algorithm grew to become excellent at recognizing what movies would entice essentially the most curiosity due to this funding, turning TikTok into one of many most addictive apps by way of time spent. As of 2020, youngsters and teenagers started spending more time watching TikTok than they did on YouTube. And earlier this month, Insider Intelligence data indicated all TikTok customers within the U.S. had been now spending a mean of almost 1 hour per day on the app (55.8 minutes), in contrast with simply 47.5 minutes on YouTube, together with YouTube TV.

Whereas Temu is nowhere close to TikTok’s sky-high figures, it seems to be leveraging an identical development technique. The corporate is closely investing in promoting to amass customers, whose knowledge it makes use of to personalize the purchasing expertise. Considered one of Temu’s key options, the truth is, is its personal form of For You web page that encourages customers to browse trending gadgets. The web page is subtitled “Chosen for You.” Along with gamification components, Temu additionally places heavy emphasis on recommending outlets and merchandise on its homepage, which is knowledgeable by person knowledge and utilization.

However the app’s development doesn’t appear to be pushed by social media. Whereas the Temu hashtag (#temu) on TikTok is nearing 250 million views, that’s not likely a exceptional quantity for an app as huge as TikTok the place one thing like #canines has 120.5 billion views. (Or, for a extra direct comparability, #shein has 48.3 billion views.) That means Temu’s rise isn’t essentially powered by viral movies amongst Gen Z customers or influencer advertising and marketing, however relatively extra conventional digital promoting.

In accordance with Meta’s ad library, for example, Temu has run some 8,900 advertisements throughout Meta’s numerous platforms simply this month. The advertisements promote Temu’s gross sales and its extraordinarily discounted gadgets, like $5 necklaces, $4 shirts, and $13 footwear, amongst different offers. These advertisements look like working to spice up Temu’s installs, permitting the app to take care of its No. 1 slot on the App Retailer’s “Prime Free” charts, that are largely powered by the variety of downloads and obtain velocity, amongst different issues.

In fact, having a excessive variety of downloads doesn’t essentially imply Temu’s app will preserve a excessive variety of month-to-month lively customers. Nor does it imply these customers gained’t churn out of the app after their preliminary curiosity has been abated. Nonetheless, Temu’s obtain development noticed it rating because the No. 1 “Breakout” purchasing app by downloads within the U.S. for 2022, based on data.ai’s year-end “State of Mobile” report. (Knowledge.ai calculates “Breakout” apps by way of year-over-year development throughout iOS and Google Play.)

As a result of Temu’s development is newer, the app didn’t earn a place on the Prime 10 apps in 2022 in both the U.S. or globally by way of downloads, shopper spend, or month-to-month lively customers on this report. As a substitute, most of these spots nonetheless went to social media apps, streamers, and relationship apps like Bumble and Tinder. The one retailer to discover a spot on these lists was Amazon, which was the No. 7 app worldwide by lively customers and the No. 8 most downloaded within the U.S.

Temu’s advertising and marketing funding might not repay in addition to TikTok’s did, although, as different low cost purchasing apps noticed comparable development solely to later fail as customers discovered that, truly, $2 shirts and denims had been offers that had been too good to be true. Wish famously fumbled as customers grew annoyed with lengthy supply occasions, faux listings, lacking orders, poor customer support, and different issues customers anticipate from on-line retail within the age of Amazon.

Temu at present holds a 4.7-star ranking on the U.S. App Retailer, however these scores have turn out to be much less reliable through the years as a result of ease with which corporations can get away with faux opinions. Dig into the opinions additional and also you’ll discover comparable complaints to Want, together with scammy listings, broken and delayed deliveries, incorrect orders and lack of customer support. With out addressing these points, Temu appears extra more likely to go the best way of Want, not TikTok, it doesn’t matter what it spends.

Source link