It’s been six months since Uber hosted Go, Get, a worldwide smorgasbord of product reveals and choices that lined the whole thing from reserving celebration buses and voice ordering for Uber Eats to linking journey plans to Gmail and skipping the meals strains at sports activities actions stadiums.

The product reveals aren’t almost creating new revenue streams or attracting clients — although these are positively aims. Uber has a a lot greater end sport: create a closed enterprise loop with each product feeding prospects once more into completely different Uber channels. And that loop is rising.

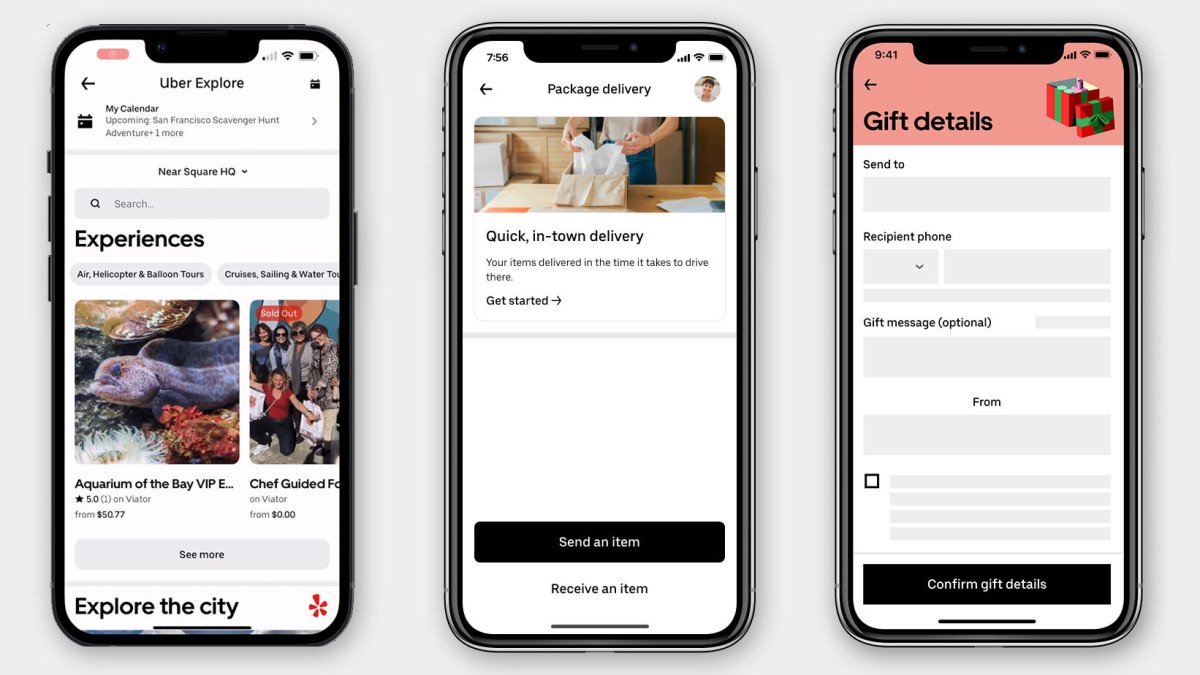

On Monday, heartened by a sturdy momentum in shopper engagement and girded for the upcoming trip season, Uber launched one different slew of product updates and new choices. This time the merchandise had been launched beneath the promoting and advertising and marketing banner of Go, get, give. Now Uber prospects can do points like e book with OpenTable and Viator by Uber’s app, search all through retailers for the most effective bottle of booze to be delivered and even schedule Uber reward enjoying playing cards to ship on Christmas day.

Amazonification

Uber was primarily based on a way of scaling the least bit costs. As Uber struggled to crack the elusive profitability nut by ride-hailing, it added its meals provide pillar Uber Eats. Now Uber appears to have taken an internet web page out of the Amazon e book of purchaser stickiness to attract new clients and get present prospects to spend more money on the platform.

Merely as Alexa, Amazon’s voice assistant, drives secondary revenue to Amazon every time a purchaser says, “Alexa, buy further shampoo and conditioner,” so, too, does Uber improve its journey revenue when a purchaser books an event by means of Uber’s partnership with Viator after which books an Uber to get them there.

Uber CEO Dara Khosrowshahi touched on this all through the agency’s third-quarter earnings identify held November 1.

“We’re actively cross-selling meals provide clients into grocery, grocery clients into alcohol, and actually once more now to mobility,” said Khosrowshahi. “All of the cross-sell that we now have all through the platform continues to increase, drive new prospects and drive retention, as successfully.”

There’s proof to counsel that, on the very least throughout the short-term, there are fruits to these labors. Inside the third quarter, Uber’s gross bookings reached $29 billion, a 26% improve from the yr prior. The company’s month-to-month full of life platform clients (MAPC) grew 14% year-over-year from 109 million quarterly clients to 124 million. If gross bookings grew at a worth faster than MAPC, we’re capable of infer that each purchaser is spending further on the platform than they could have.

“As far as the shoppers go — extreme frequency, low frequency clients — it’s utterly true that if we’re capable of switch our shopper use from lower frequency to larger frequency, we’ll see crucial growth,” said Khosrowshahi all through Uber’s Q3 earnings identify.

It’s not previous the realm of likelihood that Uber will lengthen previous the mobility space and into completely different revenue channels. The company not too way back launched a new advertising division that oversees in-app commercials all through rides. To develop that enterprise out, we’d eventually see Uber hiring creatives and using its big portions of data on riders to produce exterior promoting and advertising and marketing suppliers for producers. Who’s conscious of?

Whereas short-term research current that Uber’s depth of merchandise would possibly want purchaser stickiness, the company must be cautious of biting off larger than it might probably chew. Uber made revenue good factors throughout the third quarter, nevertheless it nonetheless misplaced $1.2 billion, just about half of which can be attributed to working losses. Tech giants and hotshot upstarts alike are throughout the midst of lowering costs — measures that embody slashing jobs — as growth turns into more durable amid the current financial system. Even Amazon shouldn’t be immune.

There are rumblings that Amazon is planning to place off 10,000 of us this week, and there’s speculation that the company’s devices group, which includes Echo, Fireside tablets and Kindles, is likely to be on the list to get cuts. At an working lack of $5 billion a yr, it’s not laborious to see why.