Inside the 170 years since Western Union was primarily based, no agency has managed to unravel two major points that proceed to bedevil the remittance enterprise — exorbitant fees and sluggish deposit events. For instance, it takes days or maybe weeks for money despatched from an immigrant inside the U.S. to attain a relative in Nigeria.

Ben Eluan and Osezele Orukpe, two software program program engineers primarily based in Nigeria, confronted this downside in 2019. That they’d executed a enterprise for a client inside the U.Okay. and when the time bought right here for them to receives a fee, they settled with Skrill. However, it took per week for the pals to get their money, they normally misplaced a considerable chunk of it to costs.

“The experience made us contemplate the funds and, additional importantly, cross border funds,” Eluan talked about to . “The gig monetary system and the service monetary system for small corporations monetary system could possibly be very massive, and we care about it ample to dedicate all our time into establishing funds for Africa.”

Over the previous three years, crypto remittance companies have emerged to fill on this need, as correctly. By means of an software program and from a pockets, people can convert fiat into crypto and ship it to the wallets of people in numerous worldwide areas who convert once more to fiat within the occasion that they choose.

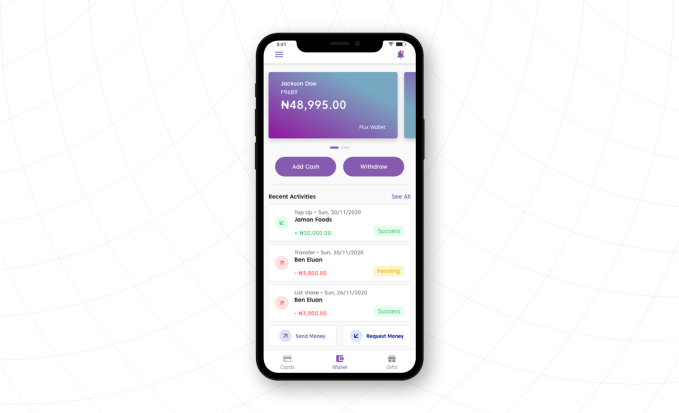

Image Credit score: Flux

That’s the an identical proposition Eluan (CEO), Orukpe (CTO) and the workforce have with their product, Flux. The crypto remittance agency was constructed to permit retailers to ship and acquire money from anyplace on this planet, Eluan tells me.

He gives that what differentiates Flux from completely different crypto remittance startups lies inside the ease and tempo of the platform’s transactions. He claims that facilitating funds on Flux is 100x earlier than fiat, and is cheaper too. The platform costs $0.50 for every transaction, regardless of the amount.

In May 2020, Flux acquired accepted into Pioneer, an accelerator launched by ex-YC confederate Daniel Gross. Pioneer gives founders entry to funding streams and experience hardly found outdoor Silicon Valley. It has already backed larger than 100 founders who give up 1% equity to affix the accelerator. Counting on their progress, Pioneer can decide to supply each $20,000 for 5%, $100,000 for 5%, or $1 million for 10%.

After this technique, Flux subsequently raised $77,000 pre-seed funding from fully completely different consumers — Hustle Fund and Mozilla, amongst others.

Eluan says the six-month-old agency has 5,000 prospects who’ve transacted over $750,000 in funds amount. Consistent with the CEO, the startup is rising 40% month-on-month and has made $25,000 in earnings.

The company witnessed this progress whatever the Central Monetary establishment of Nigeria’s clampdown on crypto change actions. The nation’s apex monetary establishment ordered local banks to stop aiding crypto transactions. This meant that crypto prospects on Flux and completely different crypto platforms could not convert fiat to crypto using their monetary establishment accounts or enjoying playing cards.

“We would have liked to be compliant because of the CBN protection and our prospects can’t really convert their crypto to fiat nonetheless can nonetheless transact their crypto. Because of this we have to make Flux obtainable inside the US and UK, the place people can use Flux and ship money to Nigeria. It’s in the mean time not obtainable nonetheless that’s what we’re establishing and is the next a part of our software program,” he talked about.

The workforce could be engaged on a peer-to-peer perform that may see prospects seamlessly transact crypto and fiat with one another. The company has launched Flux Retailers, a product that permits retailers to only settle for funds by creating payment hyperlinks for his or her companies and merchandise.

Eluan, Orukpe, Israel Akintunde (VP, Engineering) and Ayomide Lasaki (head of Promoting) — met of their freshman 12 months at Obafemi Awolowo Faculty (OAU) in Ile-Ife, Osun. Studying quite a few engineering disciplines, the 4 buddies usual a “programming membership” with completely different software program program builders on campus the place they may principally meet to jot down code and make capabilities. Eluan even tells me they incessantly skipped class for these courses.

Sooner than Flux, the pals constructed an e-commerce platform known as Joppa that helped people uncover retailers spherical them all through the metropolis. Although that they’d 20,000 prospects, Eluan says the workforce didn’t understand the dynamics of what it entailed to run a startup, so the enterprise wanted to close down.

A component that in the end led to founding Flux was the school’s budding tech experience ecosystem, which is teeming with tales of excellent startups launched by alumni. Some embrace Jobberman, Africa’s largest recruitment web page; Kudi and Cowrywise, two YC-backed companies; and Techstars agency Farmcrowdy amongst others.

“These founders bought right here from our faculty and it was an unlimited motivation for us. We on a regular basis knew that we wished to assemble one factor nonetheless we weren’t optimistic what this is ready to be. We in the end landed on Joppa, then Flux,” Eluan added.

Really, in keeping with Techpoint Africa, OAU alumni have primarily based startups which have cumulatively raised $1 million larger than completely different alumni from completely different universities in West Africa. Think about OAU as a result of the realm’s Stanford Faculty.

Image Credit score: Flux

However, not like others, the founders dropped out of the school to start out out Flux.

“We dropped out to present consideration to our startup and scaling it proper right into a $1 billion agency. We think about the prospect proper right here is massive. So for us, the exact issue to do is to get the job completed correctly. Startups need time so dropping out was inevitable,” he talked about.

Not solely are they the first set of African founders which is likely to be all dropouts to get into Y Combinator, nonetheless they’re arguably the youngest. It’s a feat Flux is thrilled about, and Eluan believes it might open the doorways for additional youthful founders on the continent.

“Successfully, we are excited about that, and it merely means good youthful people in Nigeria and Africa can undoubtedly go ahead to assemble stuff and get funded too merely like founders from the U.S.,” he talked about.

Nonetheless whereas their acceptance into Y Combinator is a much-needed validation for his or her work and sacrifice, there’s nonetheless numerous work to be completed. The startup, now primarily based in Lagos, is having fun with in a aggressive funds home. Completely completely different companies like Chipper Cash, Flutterwave, MFS Africa and completely different crypto startups try to restore cross-border funds, and there’s a race in opposition to time to grab market share. Hopefully, YC, Pioneer, completely different backers, and the workforce’s understanding of the market will propel Flux to dominance.

Source link